top of page

eCurrency

is specifically formed to enable central banks to issue CBDC

A security technology solution provider

-

Fulfills central bank requirements for issuance of CBDC

-

Provides expertise in CBDC policy considerations, design and technology implementation

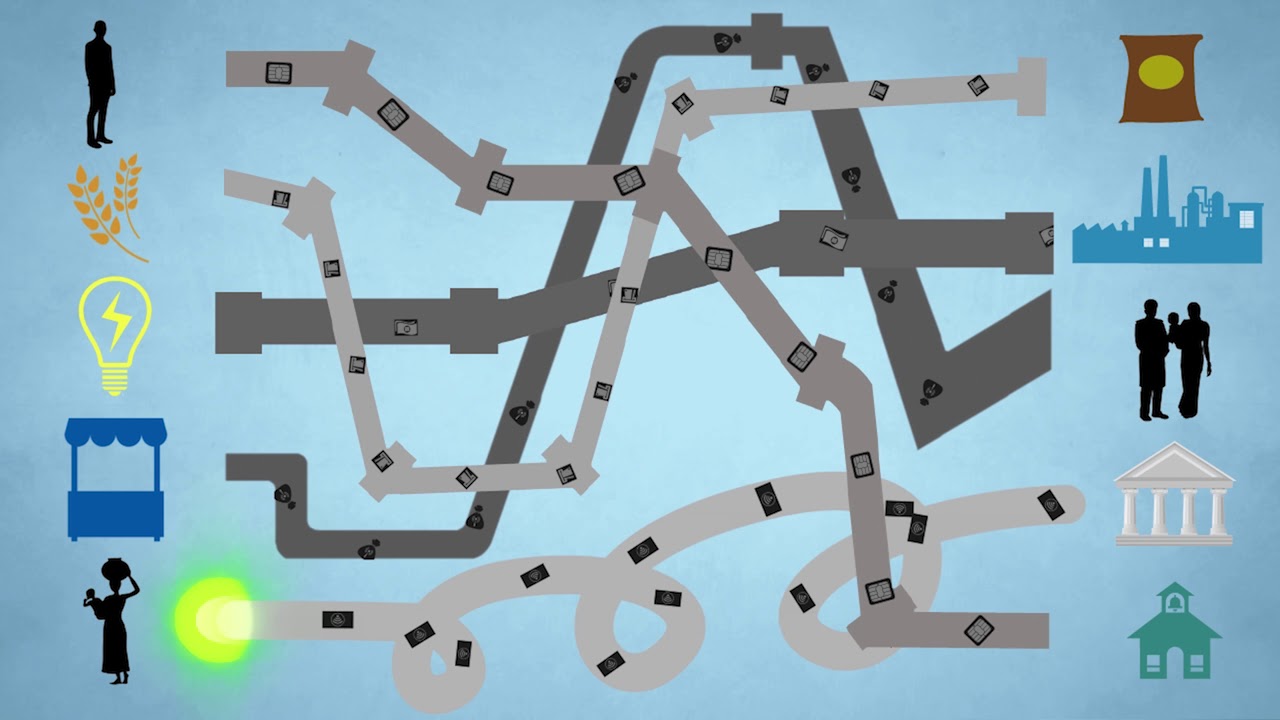

eCurrency has pioneered the world's only true CBDC solution to securely issue and distribute digital fiat currency by central banks as legal tender alongside notes and coins

bottom of page